So, let’s talk about the secondary market. For decades, the venture capital world operated on a fairly straightforward path to liquidity. A venture capitalist invested in a promising young company, nurtured it, and then, years down the line, cashed in through either a splashy Initial Public Offering (IPO) or a strategic merger and acquisition (M&A). That was the primary playbook. But over the last decade, a seismic shift has been occurring, not in the floodlit arena of the Nasdaq, but in the burgeoning, once-shadowy corners of the secondary market. What was once a niche, almost taboo, practice has exploded into a multi-billion dollar industry, fundamentally reshaping the dynamics of venture capital for everyone involved.

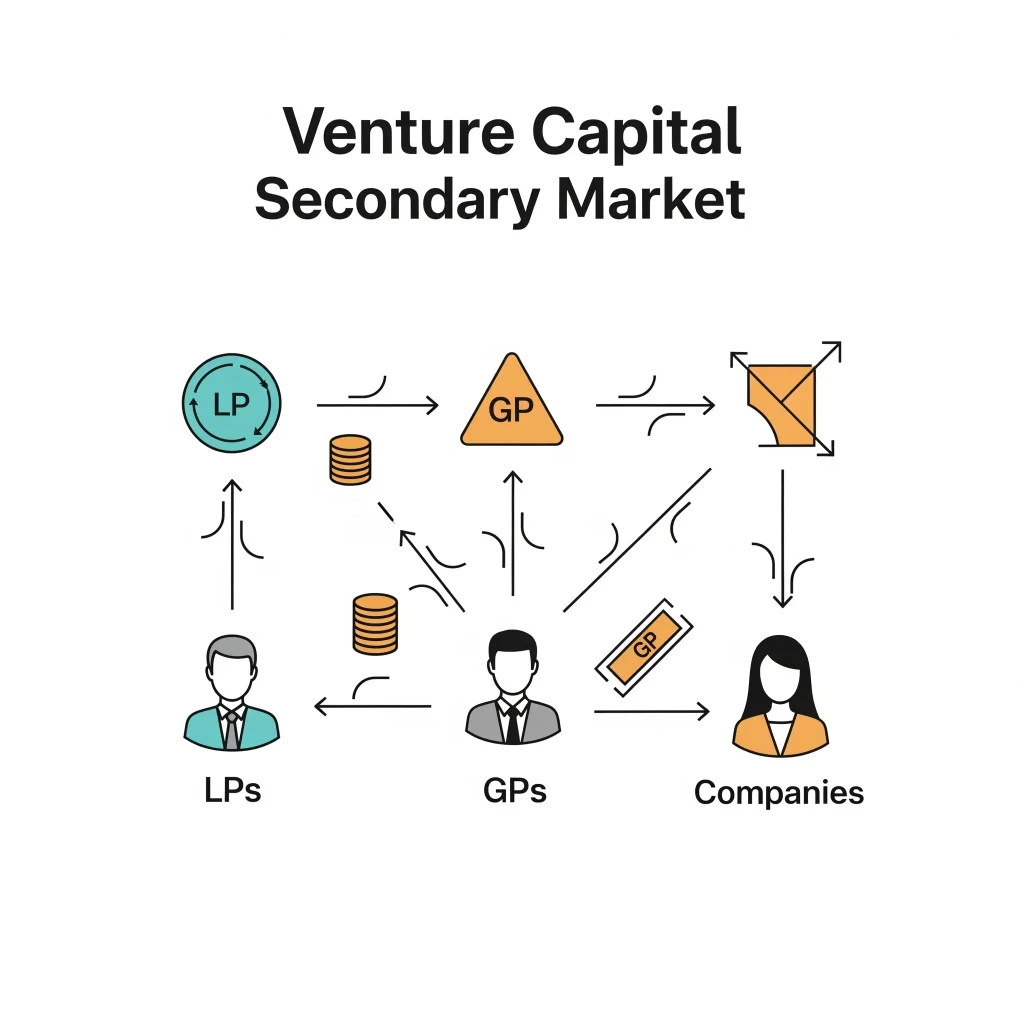

Transaction volumes in the secondary market have not just grown; they’ve surged. We’re witnessing a maturation from a market of last resort to a sophisticated ecosystem of strategic financial maneuvering. This new landscape is primarily built on three pillars: LP-led secondaries, GP-led secondaries, and direct secondaries. And each is playing a pivotal role in this transformation.

A Quicker Exit: The Rise of LP-Led Secondaries

For the uninitiated, Limited Partners (LPs) are the investors who commit capital to a venture capital fund. Traditionally, they were in it for the long haul, often waiting a decade or more to see returns. The secondary market has blown that timeline wide open.

In an LP-led secondary transaction, an LP sells their stake in one or more venture funds to another investor. Think of it as a changing of the guard. The new investor steps into the seller’s shoes, taking on the remaining capital commitments and the rights to future profits.

From the LP’s perspective, the benefits are revolutionary. The once-illiquid nature of venture capital has become far more fluid. LPs can now liquidate their holdings much earlier, sometimes just a few years into a fund’s life. This has profound implications. A pension fund, for instance, might need to rebalance its portfolio to meet new allocation targets. In the past, this was a slow, arduous process. Today, they can tap the secondary market to sell off some of their venture holdings and reallocate that capital with unprecedented speed. This creates a virtuous cycle of activity, injecting more dynamism into the market.

We’ve seen this play out on a massive scale. Institutional investors like the California Public Employees’ Retirement System (CalPERS) and Kaiser Permanente have reportedly sold off billions of dollars’ worth of their private equity and venture fund stakes in recent years. These aren’t fire sales; they are strategic moves to manage massive, complex portfolios. By selling, they not only gain liquidity but also curate their exposure to certain managers and vintages.

The General Partner’s New Playbook: GP-Led Secondaries

While LPs have been a driving force, it’s the rise of GP-led secondaries that truly signals the market’s strategic evolution. Here, it’s the venture capital firm itself — the General Partner (GP) — that initiates the transaction. The most common form of this is the “continuation fund.”

Imagine a scenario: a VC firm has a star performer in its 2015 vintage fund. The fund is nearing the end of its ten-year life, and LPs are expecting their capital back. However, the GP believes this star company still has significant growth potential. Instead of being forced to sell their stake, perhaps prematurely, they can create a new fund, a continuation vehicle, and sell the company from the old fund to the new one.

This is a game-changer. It offers existing LPs a choice: they can cash out and take their profits, or they can roll their interest into the new continuation fund to capture the future upside. This provides an elegant solution, offering liquidity to those who need it while allowing the GP to continue backing their winners.

Prominent venture firms are increasingly embracing this strategy. Insight Partners, a global venture capital and private equity firm, has executed multiple billion-dollar continuation funds. In late 2024, they closed a $1.5 billion continuation fund to support the continued growth of several of their portfolio companies. Similarly, Lightspeed Venture Partners and New Enterprise Associates (NEA) have also utilized continuation funds to provide liquidity options to their LPs and extend their relationship with promising portfolio companies.

This strategy also addresses a long-standing fear for VCs: the fear of missing out, or “FOMO,” on the later stages of their most successful investments. By creating a continuation fund, they can double down on their highest-conviction bets.

Going Direct: A New Avenue for Founders, Employees, and Investors

The third, and perhaps most dynamic, flavor of secondaries is the direct secondary. This is the sale of shares in a private company by existing shareholders, such as founders, early employees, and early-stage investors. Unlike a primary funding round where the company issues new shares to raise capital, a direct secondary is a transaction between existing and new shareholders.

For years, holding stock in a hot pre-IPO company was like owning a lottery ticket you couldn’t cash. The rise of direct secondaries has changed that. Founders can now de-risk their personal financial situations by selling a portion of their stake without relinquishing control of their company.This can alleviate immense personal pressure and allow them to focus on long-term growth rather than a premature exit.

This newfound liquidity extends to employees as well. Companies like OpenAI and Revolut have facilitated massive secondary sales, allowing hundreds of current and former employees to cash in on their vested equity. In early 2025, a tender offer valued OpenAI at a staggering figure, giving employees a chance to realize life-changing wealth. UK-based fintech Revolut has also conducted large secondary transactions, providing liquidity to its team and early backers.

These programs are powerful retention tools, making equity compensation far more tangible and valuable.

For investors, direct secondaries offer a coveted entry point into late-stage, high-growth companies that were previously inaccessible. Venture firms that missed out on the early rounds of a company like Databricks or Stripe can now acquire a stake through the secondary market, gaining exposure to these proven winners before a potential IPO.

A Market Correction and a Strategic Shift

Historically, secondary transactions were often perceived as a sign of distress, and as a result, they almost always came with a significant discount to the company’s net asset value (NAV). This created a compelling entry point for buyers with available capital. While discounts still exist, particularly in times of market uncertainty, the dynamic is shifting. For high-quality, in-demand companies, these discounts have narrowed considerably, and in some cases, shares are even trading at a premium.

This reflects a fundamental change in perception. The secondary market is no longer just for desperate sellers. It has become a sophisticated tool for strategic portfolio management. GPs are no longer just reacting to liquidity needs; they are proactively using the secondary market to optimize their funds, deliver returns to their investors, and extend their hold on their most promising assets.

The entire venture ecosystem is now leveraging this new marketplace. Founders can achieve partial liquidity and reward their teams. LPs can manage their portfolios with greater agility. And GPs can offer early exits to their investors, a powerful selling point when raising their next fund, while also gaining access to later-stage deals they might have otherwise missed.

What was once a quiet backchannel has evolved into a bustling, strategic marketplace. The surge in secondary transactions is more than just a trend; it’s a fundamental rewiring of the venture capital landscape, creating a more flexible, dynamic, and ultimately, more efficient market for all its participants. The conversation around liquidity in venture capital is no longer solely about the binary choice between an IPO or M&A. It’s now a much richer, more nuanced discussion, with the secondary market playing a leading and indispensable role.

Whether you’re a founder considering liquidity options for your team or a GP looking to optimize your fund, the strategic landscape has changed.